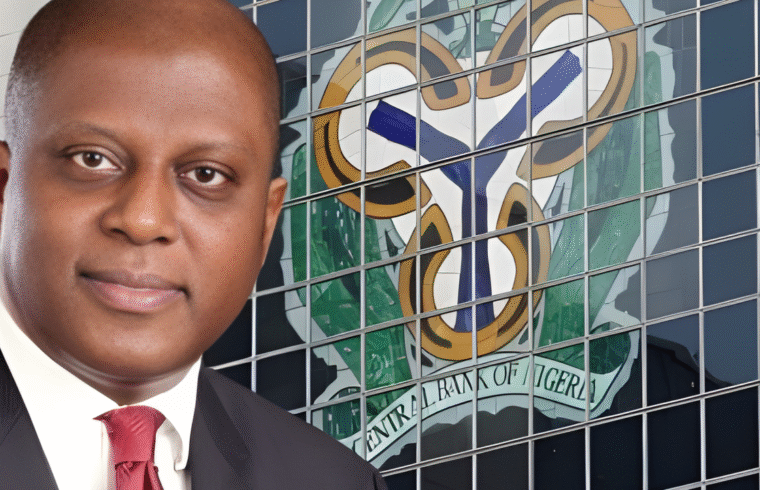

Nigeria’s economy is showing clear signs of stabilisation, according to the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, who highlighted improvements in inflation, foreign exchange, and investor confidence.

Speaking at the 60th Annual Bankers Dinner of the Chartered Institute of Bankers of Nigeria in Lagos, Cardoso said the country has “turned a decisive corner” following two years of comprehensive monetary reforms.

“The combination of easing inflation, a steadier FX market, and stronger investor confidence indicates an economy regaining balance,” he stated.

Inflation, which hit 34.6% in November 2024, has fallen to 16.05% by October 2025, with food inflation retreating to 13.12% from nearly 22%. The Governor assured that the CBN will continue calibrating policy to achieve single-digit inflation.

On the foreign exchange front, Cardoso confirmed that the CBN has cleared a multi-billion-dollar FX backlog inherited by the current administration, previously estimated at over $7 billion. The move has restored confidence among foreign airlines, manufacturers, and portfolio investors.

Key reforms driving stability include the unification of exchange rates, introduction of the Electronic Foreign Exchange Management System, and the Nigerian FX Market Conduct Code, which have reduced market opacity and discouraged arbitrage. The gap between official and parallel market rates now stands below 2%, a significant improvement from the 60% gap seen in the past.

Investor inflows surged to $20.98 billion in the first ten months of 2025—a 70% increase compared to the whole of 2024—while external reserves reached $46.7 billion, the highest in almost seven years, providing over ten months of import cover. The growth in reserves has been driven by FX liquidity, non-oil exports, and diaspora remittances, rather than fresh borrowing.

On the financial sector, Cardoso reported progress in bank recapitalisation, with 27 banks raising new funds and 16 institutions meeting or exceeding new capital thresholds ahead of the March 2026 deadline. Stress tests confirm that the system remains broadly healthy, while oversight of ATMs, POS agents, and cash distribution networks has been strengthened.

Nigeria’s recent exit from the Financial Action Task Force (FATF) grey list was described as a major achievement, easing compliance pressure on correspondent banks and boosting international confidence.

Digital payments and fintech innovations have also surged. Over 12 million contactless cards have been issued, the regulatory sandbox hosts 40+ innovators, and interoperability across switching companies has deepened. Cardoso emphasised that innovation will continue to be encouraged, but within a framework that ensures consumer protection and financial stability.

Global rating agencies have begun acknowledging Nigeria’s reforms: Fitch upgraded Nigeria from B- to B (stable), Moody’s from Caa1 to B3, and S&P adjusted the outlook from stable to positive.

Looking ahead to 2026, Cardoso outlined priorities including:

- Strengthening banks’ resilience

- Enhancing price stability via refined inflation targeting

- Expanding digital payments

- Improving fintech oversight

- Modernising CBN processes

- Building stronger domestic and international partnerships

He concluded with optimism, stating that Nigeria is better positioned to withstand external shocks, supported by a flexible exchange-rate regime, rising non-oil exports, a growing services sector, and robust foreign reserves.