Stability has returned to the Nigerian stock market after Tuesday’s unprecedented crash, which saw the Nigerian Exchange (NGX) record its biggest loss since March 2010. The market, which shed an alarming ₦4.641 trillion on November 11, 2025, is now rebounding swiftly following a timely intervention by the Federal Ministry of Finance.

For several weeks, the exchange had been declining, but the downturn hit its worst point on Tuesday when market capitalisation slipped from ₦94.526 trillion to ₦89.885 trillion.

The All-Share Index (ASI) also suffered a significant fall, dropping by 7,454.6 points (5.01%), marking its sharpest one-day decline in 15 years.

Multiple consecutive losses paved the way for the market crash, including a ₦2.8 trillion dip two weeks earlier and another ₦964 billion loss just a week ago.

The downturn hit nearly all major blue-chip stocks:

- Dangote Cement – fell 10%

- MTN Nigeria – dropped 10%

- BUA Cement – declined 10%

- GTCO – slipped almost 8%

Every key sector finished the day negative:

- Industrial Goods – down 8.5%

- Banking – down 7.3%

- Oil & Gas – down 4.6%

- Insurance – down 4.3%

Causes of the Market Crash

Experts linked the panic sell-offs to rising anxiety over a proposed 30% Capital Gains Tax on share transactions, combined with escalating global tension following threats from U.S. President Donald Trump about possible military action in Nigeria.

The mix of tax uncertainty, geopolitical fears, and year-end portfolio adjustments triggered a massive wave of withdrawals, sending the market into a tailspin.

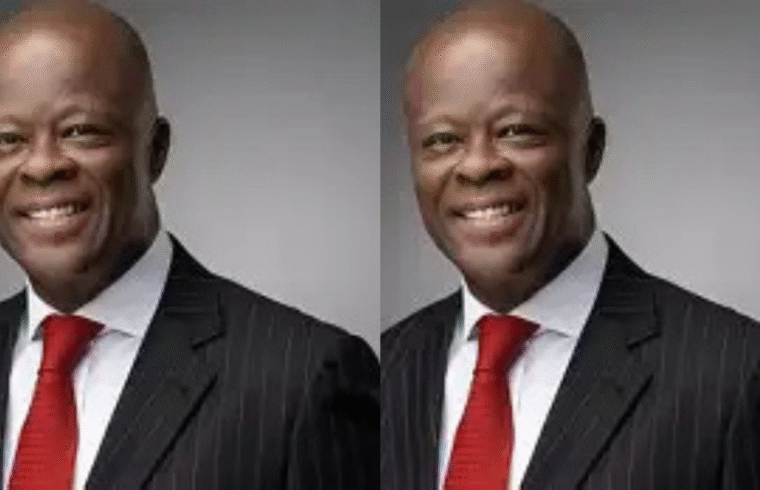

Edun Urges Calm at NGX, Assures Continuous Dialogue With Market Stakeholders

Amid rising concerns, the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, stepped in during the Closing Gong Ceremony for the listing of the MREIF Series 2 to address the tension at the Nigerian Exchange (NGX).

He appealed to investors to remain composed despite the “cautious trading” observed in the equities market, stressing that the Federal Government is fully aware of the worries tied to the proposed tax adjustments.

“We have taken note of the concerns regarding Capital Gains Tax and will maintain open engagement with the capital market to ensure any decisions produce the best outcomes for both Nigerians and the market,” Edun said.

“At ₦100 per unit, the MREIF opens the door for everyday Nigerians to save and invest, using local funds to drive economic growth—particularly in the housing sector.”

His intervention helped restore confidence almost immediately, slowing the sell-off and drawing investors back into the market.

The turnaround was swift. On Wednesday, November 12, the market surged, gaining ₦2.5 trillion in one trading session.

The positive momentum continued:

- November 13: Investors recorded an additional ₦1 trillion gain

- November 14: The week ended with a further ₦20 billion profit

With the rebound, equity market capitalisation has climbed back to ₦94.5 trillion, reclaiming most of the losses recorded on Tuesday.

Financial analyst Omiete Inko-Tariah urged investors to remain rational, warning against panic-driven decisions during market swings.

He highlighted that despite the sharp downturn, the market still holds a 40% year-to-date gain, adding that long-term opportunities remain strong.

Speaking on a podcast, he explained:

“Every market crash reveals the same truth: money doesn’t vanish—it shifts hands. From the fearful to the patient. From sellers to buyers. Never panic sell.”

He continued:

“When investors dump quality stocks out of fear, that’s when wealth silently moves from the impatient to the informed. Market dips reset valuations and give regular investors a rare chance to acquire premium assets at deep discounts.”

Encouraging investors to stay strategic rather than emotional, he added:

“Remember, buying stocks means buying into businesses—not just price movements. Smart investors don’t run from fear; they take advantage of it.”