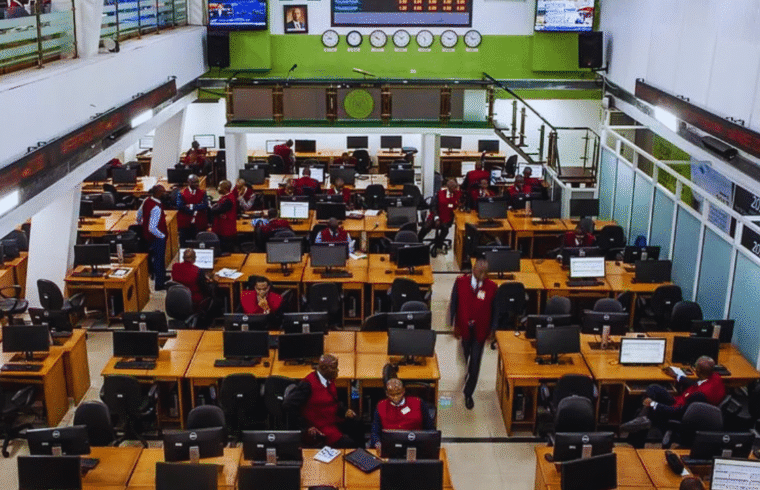

Nigerian Stock Market Gains ₦1.81 Trillion Amid CBN Reforms – September 2025

Investors in the Nigerian stock market recorded significant gains in September 2025, as total market value rose by ₦1.811 trillion, driven by renewed confidence following the Central Bank of Nigeria’s (CBN) monetary reforms.

Impact of CBN’s Monetary Policy

The CBN’s decision to cut the Monetary Policy Rate (MPR) to 27% from 27.5% spurred investor appetite for equities. This prompted a shift away from fixed-income assets into stocks, boosting overall market activity.

Market Performance in September 2025

An analysis of figures from the Nigerian Exchange Limited (NGX) revealed:

- Market Capitalisation: Increased to ₦90.580 trillion in September from ₦88.769 trillion in August — a gain of ₦1.811 trillion.

- All-Share Index (ASI): Rose by 1.7%, moving from 140,295.50 points in August to 142,710.48 points at the close of September.

On Tuesday’s trading session alone, the NGX ASI advanced by 0.23%, closing at 142,710.48 points, while market capitalisation added ₦445.2 billion, ending the day at ₦90.58 trillion.

Top Performing Stocks

The rally was largely fueled by increased demand in large-cap equities, including:

- ARADEL (+9.82%)

- Fidelity Bank (+5.26%)

- Nigerian Breweries (+2.38%)

- Transcorp (+8.48%)

However, despite the positive momentum, market breadth closed negative, with 31 decliners against 28 gainers.

Analysts’ Perspective

Market watchers described the rebound as a mix of optimism and caution:

- Optimism: Driven by expectations of strong corporate earnings, sector-specific strength, and CBN’s reforms.

- Caution: Influenced by inflation trends, exchange rate volatility, and global economic signals such as crude oil prices and international risk appetite.

According to analysts at InvestData Consulting Limited, the equities market is likely to continue recovering cautiously, but its sustainability depends heavily on Nigeria’s macroeconomic stability.

Outlook

The strong performance of the NGX in September reflects renewed investor confidence in equities as a viable investment class. However, analysts warn that macroeconomic fundamentals will play a decisive role in determining whether the rally can be maintained in the months ahead.